- January 29, 2021

- Posted by: adminz

- Category: News

Production decreases at mines around the globe, retail closures and fractured supply chains weighed heavily on the diamond sector in 2020.

Declines in mine output were countered by a drop in sales, softening some of the impact. Demand fundamentals later improved during the second half of the year, though supply stayed depressed.

Moving forward, the diamond market’s underlying supply challenges are anticipated to worsen.

“Following the recent high watermark in 2017, global diamond production subsequently declined in 2018, 2019 and 2020, and is forecasted to remain below 2017 levels for the foreseeable future as multiple legacy mines reach depletion and minimal new production offsets declines,” said analyst Paul Zimnisky.

Closures and staffing reductions related to Covid-19 worked to further reduce output.

“In 2020, pandemic-related production suspensions and curtailments across the industry accelerated this decreasing supply trend,” he explained to the Investing News Network (INN). “More specifically, in 2020, I estimate that global diamond production volume decreased by over 20 percent to about 113 million carats. This is the lowest output since the 1990s.”

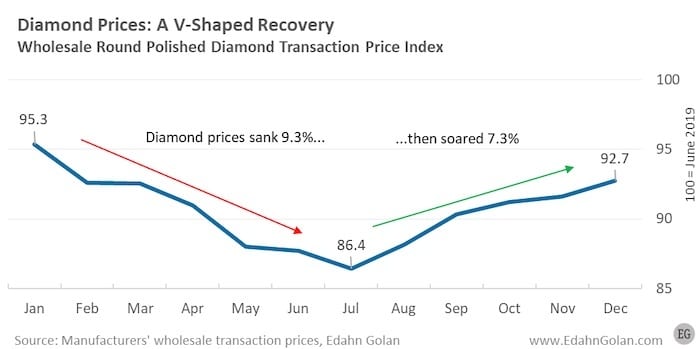

Q2 bore the brunt of the impact, while the second half of the year registered a recovery, commented Edahn Golan, diamond researcher and analyst.

“We saw a decline across the board, mainly in the second quarter of 2020,” Golan said to INN about the broad impact COVID-19 had on the space.

“In June, jewelry retail sales surged and continued to grow through December, when they hit record highs. The resurgence of retail activity led to a revival in wholesale polished prices, which ultimately posted a V-shaped recovery.”

The broad decline in retail demand meant that there were not bottlenecks due to COVID-19, which likely aided in the market recovery during H2.

Diamond trends 2020: Luxury item or safe haven asset?

All commodity classes faced price declines in March due to the swift impact of COVID-19, but gold and silver ultimately benefited from their safe haven status.

The idea is that these precious metals are cushions for market volatility and hedges against inflation. Diamonds, which are viewed as a luxury item, usually don’t benefit as broadly from safe haven demand.

Even so, diamond sector participants have long touted diamonds as a safe haven due to their mobility, steady value, appreciation and tangibility. However, as Zimnisky explained, it’s hard to know if there was an increase for that specific demand segment during 2020.

“I have certainly heard anecdotes of this; however, it is very difficult to quantify,” he said. “One thing that is for certain is people are converting fiat currency to ‘things,’ whether it be stocks, precious metals, precious gems or even sports cards and other collectables.”

According to the diamond analyst, the shift seen in 2020 is directly correlated to fear of currency devaluation. “The hockey and baseball card market is the hottest it has been in decades,” said Zimnisky. “I think there is legitimate concern of currency debasement and inflation given the recent level of stimulus and artificially low interest rates.”

Diamond trends 2020: Recovery counters early year losses

An increase in investor interest in Q2 wasn’t enough to offset losses in the first half of the year. As Golan pointed out, the US jewelry sector faced a US$4.8 billion decrease in sales between March and May.

“However, the recovery in the second half of the year made up for that loss. I estimate that US jewelry sales ended flat to an estimated 1 percent growth year-over-year,” he said. “In China, the world’s second largest jewelry market, 2020 sales were clearly ahead of those in 2019.”

As demand slipped, so did prices. “Wholesale polished diamond prices fell 9.3 percent between January and July,” the diamond researcher and analyst told INN. “However, by the end of December they rose 7.3 percent, making a near full recovery.”

Rough diamond prices experienced a 12 to 15 percent drop in 2020 and have begun to recover in recent months. The current uptick in prices is due to diamond polishers selling backed-up inventory and initiating the rough diamond buying process.

In the second half of 2020, when lockdowns began to lift, there was a resurgence in some diamond buying, especially during the holiday season of November to December, and a strong uptick in demand was recorded. “This has continued through the end of the year and into the new year,” said Zimnisky.

“The reality is, people with money seem to be doing quite okay, or even good, during the pandemic, while people without money have been the most impacted by the economic conditions. Financial markets are at all-time highs. It’s pretty incredible what’s happening right now as far as wealth dislocation. It’s sad.”

Diamond outlook 2021: Mine closures weaken supply

As mentioned, 2020 saw a number of legacy mines wind down or near the end of their lives.

One of the most prominent was the Argyle mine in Australia. Operated by Rio Tinto (ASX:RIO,LSE:RIO,NYSE:RIO), the mine opened in 1985, and has produced roughly 90 percent of the world’s pink and red diamonds. After 37 years of operation, it closed in November 2020.

In addition to the colored diamonds, Argyle was a significant source of small white diamonds.

When asked if the market will be impacted by the shuttering, Zimnisky explained that the closure had been pending for quite some time, allowing for the market to make accommodations where it could. That said, he did note that taking that much supply offline at once will be hard to offset elsewhere.

“(The closure) was well forecasted, so the supply shock will not come as a surprise, per se, to the market,” he said. “However, the closure of Argyle will result in a reduction of approximately 10 million carats of small diamonds annually, which should be supportive of the supply fundamentals of small diamonds.”

For Golan, Argyle’s closure was most impactful to the Indian market.

“The Argyle diamonds were mainly lower-priced, brownish-colored goods,” he said. “They primarily served the Indian polishing sector, which were the most impacted by the decline”

He went on to point out, “Strong demand for Canadian goods at the rough tenders in January indicates that these manufacturers found a substitute.”

Diamond outlook 2021: What’s ahead?

Despite the recovery that began to take place for the diamond market in H2 2020, the impact of COVID-19 has weighed heavily on the sector.

This was evidenced by the revision of Moët Hennessy Louis Vuitton’s (LVMH) (OTC Pink:LVMHF, EPA:MC) acquisition of Tiffany & Co. (NYSE:TIF). The original November 2019 deal saw LVMH offer to pay US$16 billion for the renowned jewelry house.

A year later, the deal closed for US$15.8 billion, a US$4 million reduction in value.

As the diamond market continues to recover from 2020’s upheaval, Golan believes companies have an opportunity to rebrand and think of better ways to engage potential buyers and investors.

“First and foremost, retailers are expected to invest in their online presence,” he said. “The need to reach clients that are not present in their store — (that) was the leading conclusion retailers arrived at during the pandemic. So expect them to focus on their websites and social media efforts going forward.”

As for the midstream, Golan expects a renewed focus on efficiency and streamlining.

“That means buying goods when needed, less speculative rough diamond purchases, improving efficiencies in manufacturing to drive greater returns from their rough diamonds and (more of a focus) on what their clients need, instead of on what rough they happen to have,” he added.

One of the positive developments to occur over the last year, according to Golan, was the enhanced use of big data to increase productivity.

“They sought to improve their marketing and better understand market trends through big data,” he said. “They gained so much from this process that they are already expanding internal process(es) to incorporate this additional information.”

Offering a more macro view, Zimnisky explained that out of 2020 emerged a more cautious market that is poised for future growth.

“Excess diamond inventory has shifted from the midstream to the miners in recent years, which was accelerated in 2020 by the conditions,” said Zimnisky. “It can be argued that it is preferable for excess diamond inventory to be in the hands of the major miners, which are well capitalized, rather than the very fragmented and independent diamond midstream.”

“I think this will make the whole diamond supply chain better positioned in the years ahead.”

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence. – investment news.com